Succession planning for Swiss private real estate

Establishing a Swiss family foundation is also only of limited use as a solution due to the prohibition under civil law on entailed estates; moreover, such a foundation is subject to stringent regulation and tight restrictions. A Liechtenstein family foundation, on the other hand, would be an ideal and flexible structuring instrument. However, under the Federal Act on the Acquisition of Real Estate by Persons Abroad (the so-called "Lex Koller"), such a Liechtenstein family foundation would be deemed a person abroad and therefore cannot be meaningfully used for the holding of Swiss private assets. What is the position, however, with regard to a Liechtenstein trust, an equally tried-and tested succession planning instrument?

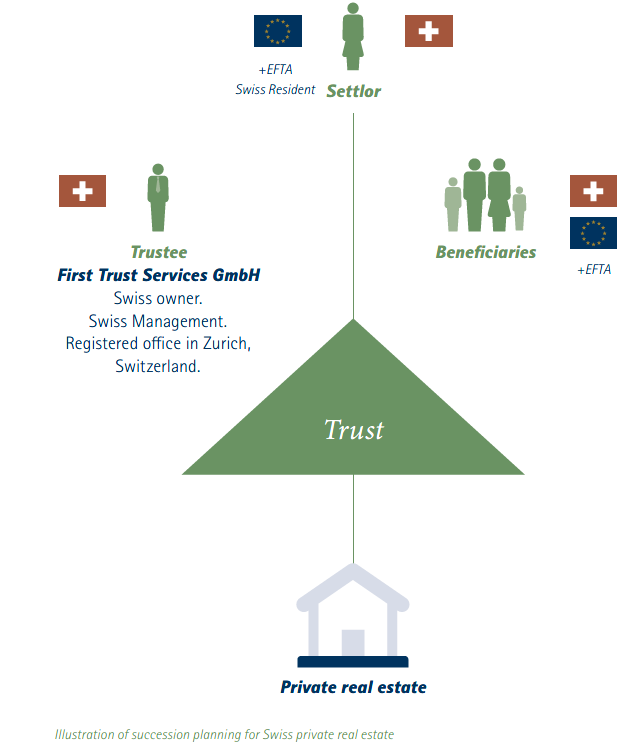

Clients like to place their trust in institutions. In the case of natural persons acting as trustees, the succession arrangements with regard to a client's assets must be clearly specified otherwise there is a risk that these assets will end up in the estate of a deceased trustee, from which they could only be accessed with difficulty. This is the reason why institutional trustees, such as First Trust Services GmbH which, as legal entities, have no risk of decease, are more in demand than ever. The First Advisory Group has been offering Liechtenstein corporate trustee and succession solutions for decades and has a wealth of experience in the corresponding structuring and administration of Liechtenstein trusts.

With regard to the specific client requirements in Switzerland as described above, the First Advisory Group has developed a solution and has established First Trust Services GmbH with registered office in Zurich, to act as a "corporate trustee" which futlly meets the requirements of a Swiss trustee. The new company is registered with the SRO Financial Services Standards Association (VQF) and is currently in the process of linking up to the new Supervisory Organization (AO) for Trustees. This will allow, Swiss citizens, as well as citizens of the EU/EEA resident in Switzerland, plus citizens from other countries holding a Swiss Permanent Residence Permit (Permit C), to satisfactorily structure their Swiss private real estate and make succession arrangements using Liechtenstein trusts.

Advantages

- Trustee is fiduciary owner of the Swiss private real estate donated into the trust

- Separation between settlor and trust under civil law (asset protection)

- Five-year statute of limitations following introduction of assets

- Securing freedom of action (e.g. in relation to possible intervention from the Child and Adult Protection Authority (KESB))

- Succession planning in accordance with the will of the settlor

- Consolidation of indivisible assets

Conclusion

"As a young lawyer, I was confronted with the problem following a death of a client that a private property had to be sold, since the surviving wife and advocates of the minor children (today, this would be the KESB) were not able to agree on a solution satisfactory to everyone. I'm convinced that this would not have happened with such a trust solution."

Peter Grüter, attorney-at-law and Managing Director, First Trust Services GmbH, Zurich

"Even in the context of complete surrender of control, the introduction of Swiss private real estate into a Liechtenstein trust is possible on a tax-neutral basis in many cantons of Switzerland. This also applies with regard to the transfer of other private and business assets into such a trust. In this way, it is possible for a family to hold both movable and immovable assets in a discreet, secure and tax-efficient manner over many generations. This is the true added value which we are able to offer our clients."

Ralph Thiede, tax expert and Managing Director, First Tax Trust reg., Vaduz.