Digitised securities accounting (eWeBu)

Project Insights

Together with ONE PM AG (ONE PM), CSL Corporate Services Establishment (CSL) was able to implement digitalised securities accounting in a customer project. A task that required very close cooperation between business and IT and was also much larger in scope than initially anticipated. Tino Kesseli, Head IT, asked the various project members about the challenges.

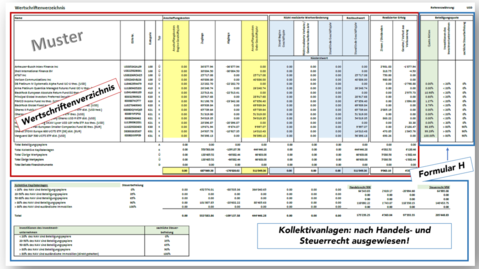

Key points of the solution

The solution is based on ONE PM's portfolio management system (PMS). ONE PM specialises in the automated booking of bank transactions and has a large number of automated interfaces to banks. Both nationally and internationally.

CSL implemented the accounting requirements based on this data. To ensure that the solution is practice-orientated, the functionality was defined and implemented together with First Accounting AG (FAE) and FDS Financial Data Services AG (FDS). Like CSL and ONE PM, both are group companies of First Advisory.

The dialogue partners are:

- Rita Zogg, Digitalisation Accounting & Finance, CSL Corporate Services Est.

- Markus Vetsch, Senior Software Developer, CSL Corporate Services Est.

- Alfred Meier, Head of FDS Financial Services AG

- Andreas Brotzer, Head First Accounting AG

- Markus Jufer, Project Manager, ONE PM AG

TK: Rita, as the former managing director of First Accounting and later also of FDS, you agreed to work part-time at CSL for this project. What were your motives?

Rita: Many years ago, we digitised a large part of our securities accounting with First Accounting Est. Even back then, working with CSL was a great pleasure. When I was asked whether I would be willing to work on a solution that would further automate the existing solution, I didn't have to think long and was happy to accept.

TK: When you look back on the two years of the project, what were the biggest challenges?

Rita: In a project of this size, with so many parties involved, it is crucial that everyone involved is talking about the same thing and has a common understanding. The accounting requirements, such as value adjustments, realised and unrealised profits, were not known to everyone from the outset. Therefore, numerous meetings were necessary in which we imparted and shared knowledge. Only with these details was it possible for the development team to design the solution as it is today.

TK: Markus, what challenges did ONE PM face in terms of implementation?

Markus J.: Interesting question, there was a lot to doJ We had to expand our data model to include elementary entities. For example, calculated values for value adjustments had to be saved so that they could be used again when they were reversed. Or the option had to be created to carry out the value adjustment according to the market or lower value principle.

TK: How did you deal with the challenges?

Markus J.: We see the developed solution as a significant added value and a unique selling point of our software. It is not only of great interest to our existing customers, but also opens up new business opportunities. That's why we were happy to tackle the new tasks. In doing so, we were also able to tackle a number of issues that add qualitative value to the solution. Some keywords here are "standardised booking texts", "retroactive booking changes" and securities management.

TK: What specific additional business opportunities do you see for existing customers?

Markus J.: Our asset management clients can now also offer their end clients accounting data with a full level of detail. This can be of particular interest to companies as end customers, such as pension funds, fund or asset managers, who want to prepare detailed accounts or even have to do so due to regulations. Digitisation can greatly reduce the costs of preparing accounts.

TK: Markus Vetsch, what was your role in the project?

Markus V.: My first task was to analyse and understand how the previous workflow was structured when transferring securities accounting to financial accounting, which automation and digitisation steps could be implemented and which requirements existed in detail for the new financial accounting export workflow application in general and the interface to ONE PM's PMS in particular.

Following a business analysis, we realised the API-based interface to ONE PM in order to enable direct communication without media discontinuity between the two subsystems PMS of ONE PM and the financial accounting export of CSL. In a further step, by developing a flexible set of rules, we created the option of generating posting records for financial accounting from securities transactions in the PMS in the financial accounting export application, taking into account the associated chart of accounts.

In general, a major challenge was to familiarise myself as a person from outside the field with the commercial principles of accounting, including the profit and loss account, and to find a common language with all the specialists involved in the project. This was not always easy...

TK: What characterises the solution?

Markus V.: The complete eWeBu solution enables the direct transfer of securities accounting to financial accounting on the basis of a flexible set of rules that can be parameterised individually for each customer or chart of accounts. In this way, we are able to map various financial accounting requirements, for example from fiduciary services or asset management, from a standardised database in ONE PM's PMS.

As an elementary component of the overall solution, ONE PM's PMS is responsible for the standardised processing of securities transactions reported automatically by banks or entered manually by humans, as well as for the correct handling of the profit and loss account.

The export workflow realised by CSL enables the processing and conversion of securities transactions retrieved from the PMS into posting records for financial accounting.

We are not tied to a specific format, a specific interface or a specific accounting system for financial accounting exports. The export format of the posting records as well as the interface to a financial accounting system are interchangeable in order to be able to serve a broad customer base.

TK: How does the customer work with the solution?

Markus V.: Both the PMS and the financial accounting export workflow are modern web clients that can be used by customers in the most common browsers. In this way, we avoid the need to distribute the solution to many workstations and maintain it there. This technological approach allows us to remain flexible for future requirements - keyword "cloud"J .

TKE: Alfred, to what extent were you involved in the project as a representative of the FDS, or what was your role?

Alfred: In my role as a stakeholder, I was sometimes consulted on issues relating to the requirements. Our part was relevant in the various test phases. We were able to use our expertise as securities professionals to further refine the product and also test special cases. Based on what I have seen so far, I see considerable added value! I'm looking forward to the next steps, especially the launch of the product!

TKE: Alfred, FDS already offers digital securities accounting as a service for its customers. What do you expect from the new solution?

Alfred: A few thingsJ We already had a solid product. However, certain work steps still had to be carried out manually. These processes have been further optimised with the new solution. In addition, ONE PM now provides us with many more automated interfaces, which makes our services even more attractive. Existing and new FDS customers will also benefit from this.

TKE: Andreas, you are already an FDS customer with First Accounting. What do you expect from the new solution?

Andreas: As Alfred has already mentioned, the new solution is even more advanced, which will enable us to further optimise our work processes. In particular, the time required to import data into the financial accounting system will be further reduced, freeing up additional resources for other tasks. The extended options for automated bank interfaces will also help to further reduce our internal costs.

TKE: Do you also hope that the new solution will open up opportunities in sales?

Andreas: Definitely yes! The additional interface banks in particular are a major advantage here. If a customer previously had a main bank that was not automated, we were interesting in our offering, but not compelling. With the expansion of the automation options, our offer becomes almost irresistible. Due to the further optimised work processes, we assume that these improvements will enable us to acquire additional customers for whom we can provide annual statements using "white labelling".

TKE: Are there any other advantages that are worth mentioning?

Andreas: The labour market in our industry is currently highly competitive and it is difficult to recruit qualified specialists. Digitalisation not only allows us to reduce internal costs, but also to speed up our processes. This gives us the opportunity for growth without having to significantly expand our workforce.

Many thanks to everyone for the interesting Insides. We will be publishing more information on electronic securities accounting in the coming months. If you have any questions about the implementation or the offer, please do not hesitate to contact us at any time. If you are interested, you can also contact the companies involved in the project directly.

Please contact the following persons:

CSL Corporate Services Est., www.csl.li, Tino Kesseli. eMail:

FDS Financial Services AG, www.fdsag.li, Alfred Meier, eMail :

First Accounting Est., www.first.li, Andreas Brotzer, eMail :

ONE PM AG, www.one-pm.com, Fabio Giuri, eMail :